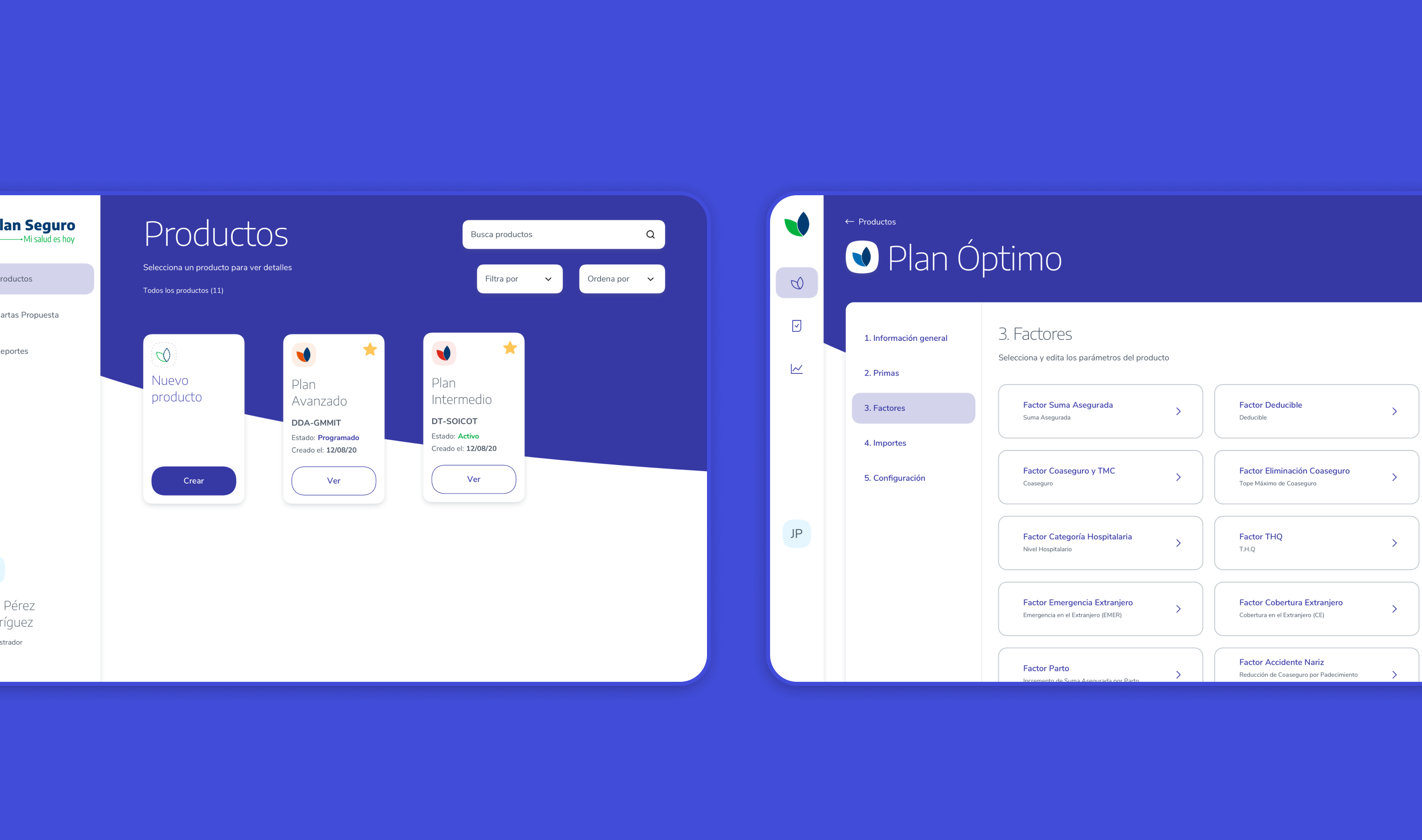

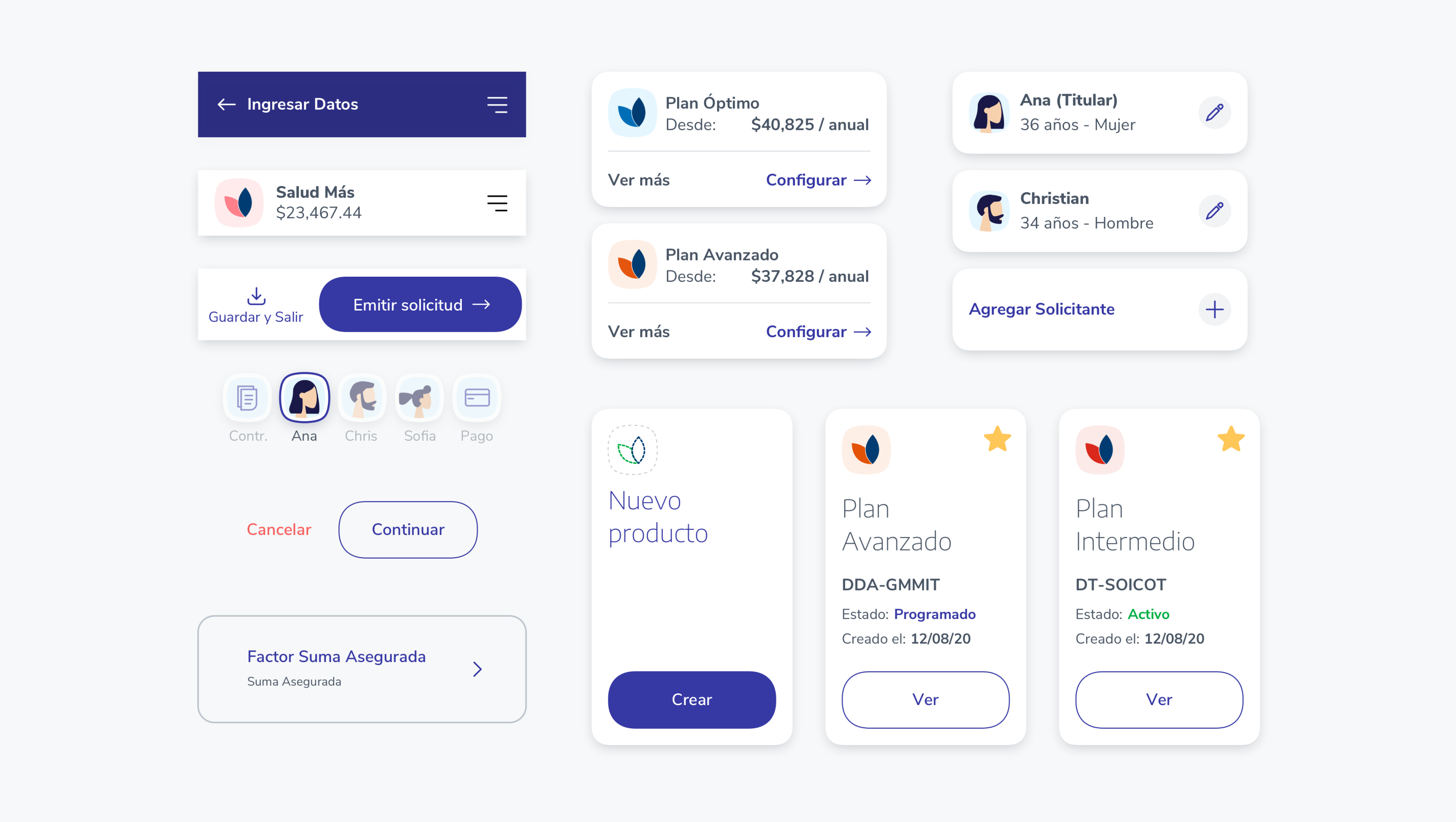

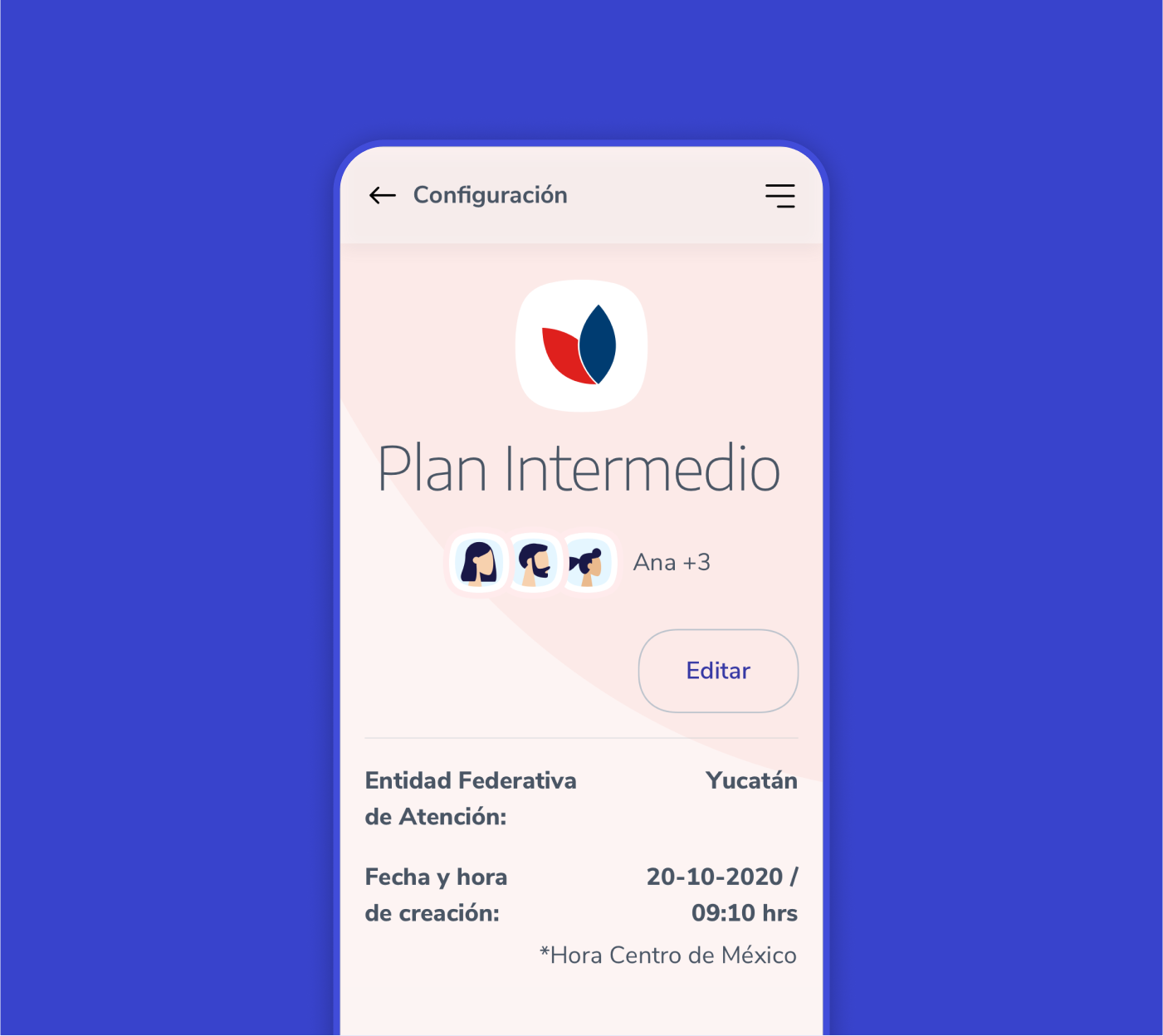

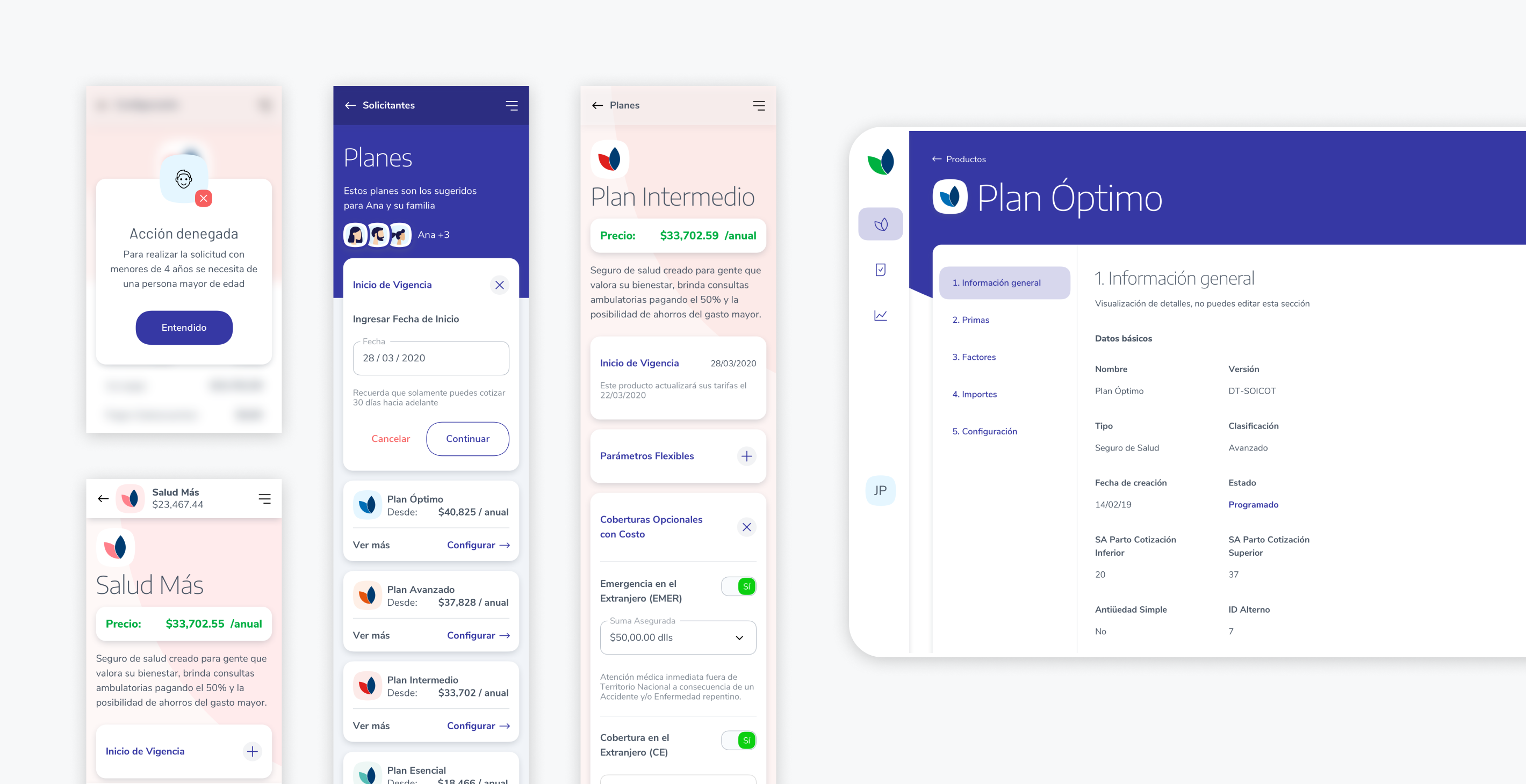

We streamlined the Insurance Plan quoting process with a new quoting tool that fully integrates with the agents' sales process and offers customers a precise insurance quote.

Cliente

Sector

Insurance

Metodología

Discovery

Usability Testing

Digital Strategy and Product Design

User Experience

User Interface

Digital Experience Development

The challenge

Understanding the process of selling insurance to transfer it to the new digital quoting tool

Multiplica was approached by Plan Seguro to develop a quoting tool for its Health and Major Medical Expenses insurance. The project was expanded beyond the quoting tool to include the ability to submit insurance requests through the same process, removing the need for any paper interaction.

Plan Seguro faced the following challenges in executing the project:

1) Develop a strategic vision for the project that incorporates the different areas’ goals.

2) Break down the agents’ preconceived notions so that they can become accustomed to working with the new processes.

3) Integrate consumer authentication and double authentication solutions that meet all legal criteria while not overly complicating the process for the customer.

The following were some of Multiplica’s challenges in completing the project:

1) Being involved in the communication process between various areas in order to form a common perspective.

2) Listen to users and clients and relay the results to them.

3) Integrate all internal Plan Seguro processes and the agents’ sales processes.

4) Create a platform that would merge with these processes and act as a sales ally.

What we did

Identifying client and agent needs in order to reimagine the insurance quoting tool

Workshops were held to identify the problem and create journeys with the client at the beginning of the project. We wanted to brainstorm together what difficulties we needed to tackle and what project goals we wanted to achieve. We began to get a sense of what the quoter might be like based on this initial information. Later, we spoke with various departments, including those responsible for agent relationships and customer support.

During these sessions, we identified their sales team’s issues and impressions of their existing quoting tool. In turn, we spoke with agents with different profiles about their experiences and perceptions of Plan Seguro.

At the same time, we worked on UX ideation, and our technical lead was in charge of establishing the algorithm for the five items we’d be working on, as well as providing a quote that included actual rates for each of the plans and developing the flows.

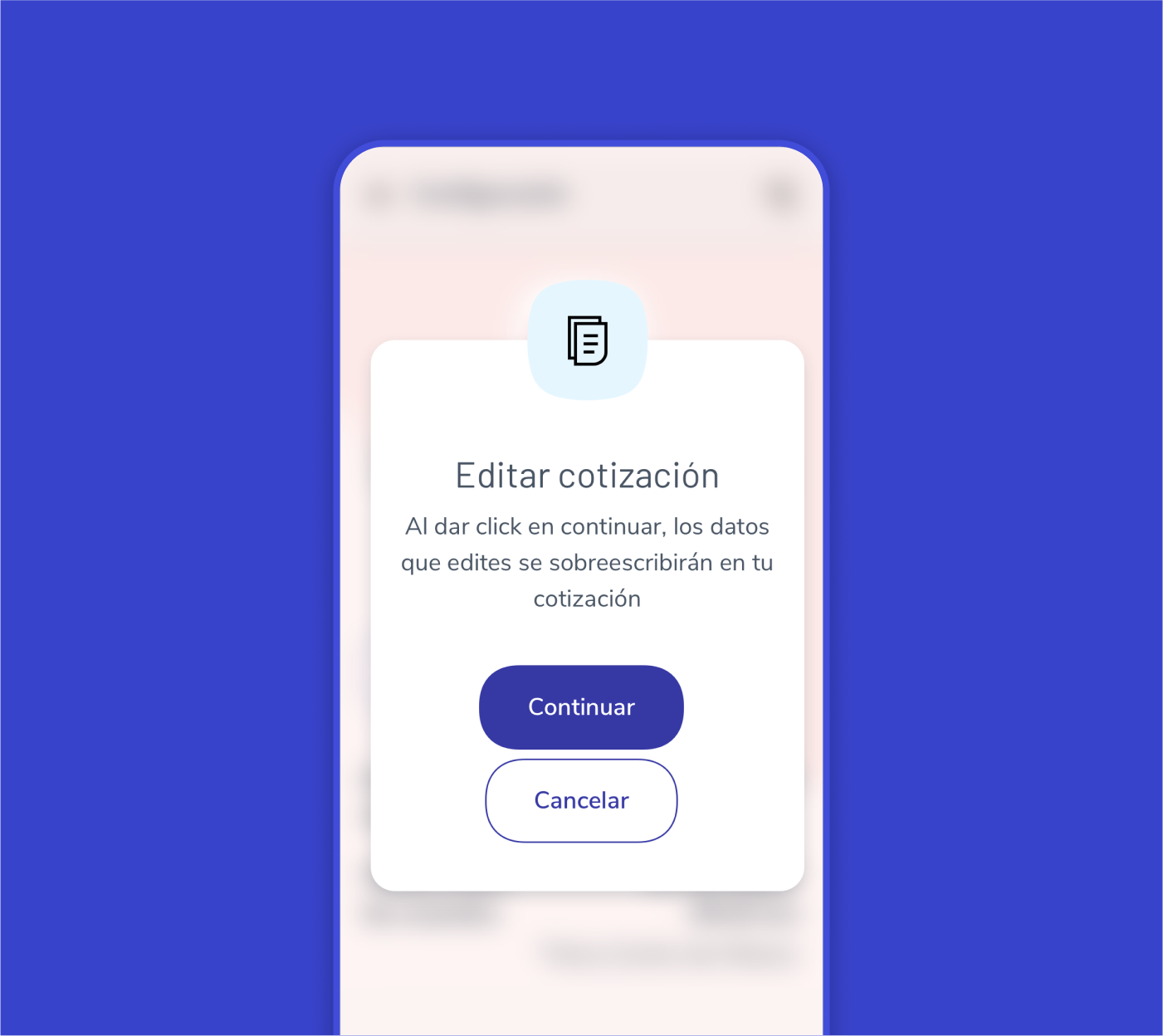

We conducted usability tests with end users to validate the prototype. The quoting tool and a CMS to manage it were then created, which were also evaluated by Plan Seguro’s internal users through usability testing to assure its incorporation into their operations.

Key learnings

The importance of having all participants at the table in order to properly explain the value we bring to the table and the expectations we can have from the project.

Demonstrate to the customer that a quoting tool is a live product, not a fixed product, and that in order for its value to endure, it must continue to evolve.

Resultados

Pedro Durán

Director of Actuarial Development at Plan Seguro

Destacamos

The relationship we had with the client was built on trust,

and it drove us to work on other projects connected to the various aspects of their journey that they wanted to expand.

The team’s commitment,

as well as their ability to have the necessary receptivity to digest all of the information they had given us about their business and shape it into the quoting tool.

We have become specialists in the insurance industry as a result of mutual learning,

and Plan Seguro has used the knowledge to develop internal digital projects.